Select a Topic Below

We've gathered some of your most frequently asked questions and have provided answers. Still have a question? Contact Us.

These types of scams are way to lure you into entering your personal details on a fake website that looks exactly like the legitimate one. Phishing tries to acquire information such as usernames, passwords, and credit card information by pretending to be a trustworthy site. This is usually carried out by fake emails or text messaging.

Please be aware that BCB Bank will never initiate an email or text message asking you to provide personal or financial information. If you mistakenly respond to a fraudulent email, mobile message or phone call, please contact us immediately at 201-823-0700.

Example below: A recent phishing example sent to a customer imitating BCB Bank communication.

Identity theft is a crime in which a criminal obtains pieces of personal information, such as Social Security or driver's license numbers, in order to pose as someone else. The information can be used to obtain credit, merchandise, and services using the victims' name. Identity theft can also provide false credentials for immigration or other applications.

One of the biggest problems with identity theft is that very often the crimes committed by the criminal are often credited to the victim. For more information on Identity theft and what to do if you're a victim of identity theft please click here.

BCB Bank values its Customers and their financial well-being. We want to provide key information to help our customers become aware of important alerts. (i.e. fraud incidents) or information about new rules and regulations that may affect you.

At BCB Bank we would like to get you up to speed on the newest and best ways to protect yourself online.

The following is a checklist of online banking tips that will help you keep your financial and personal information safe and secure.

For more information about Cyber Security go to the Department of Homeland Security website at Department of Homeland Security

Tab nabbing is when a website secretly replaces an existing tab that is open with a fake one. The user is duped into to signing back on to the website that they think has timed out.

Once the person has entered the information the tab then redirects you back to the original tab. In other words, the web page never timed out, a suspicious site was opened in some other tab and secretly changed its content to become a 'look-a-like' of the tab site you were on.

Once you put in your information again and press enter you have given the suspicious site your information. You can prevent Tab Nabbing by playing it safe. If you see that a site has timed out or is requesting you reenter your information it is best to type in the URL of the site again to ensure that you are on the legitimate site.

Click here to view our privacy notice for additional details on disclosure of account information.

BCB Bank will never ask you to update your account information via email, mobile messaging or telephone contact. Should you receive an email with this type of request consider it fraud. DO NOT RESPOND to it and IMMEDIATELY DELETE it from your inbox.

We will never initiate a call to you and ask you to provide personal or financial information over the phone. Additionally, we will not send mobile messages requesting customers to update their financial or personal information. If you mistakenly respond to a fraudulent email, mobile message or phone call, please contact us immediately at 201-823-0700, or click here for after business hours to report any fraudulent activity.

As the use of digital and online banking continues to grow, fraudsters have embraced this as an opportunity to expand their method of targeting by creating fake banking websites to steal user information. The number of fake sites has increased significantly over the past few years and typically this deception goes unnoticed.

Pop-up windows. These pages may look exactly like the actual bank pages, but they appear in a way that is never the case with the real ones provided by your bank. Fraudulent pages open in pop-up windows and prompt you to enter your personal details and credentials.

1. Check for legitimate addresses

Many fake banks may provide an invalid mailing or physical address which you can’t find on a map, or the address of a legitimate bank under another name.

2. Invalid social media links

Almost all banks these days have active social media accounts. If the online bank you’re looking at doesn’t have any social media links, or if the links they provide don’t go anywhere, there is a good chance that they’re not a legitimate bank.

3. Not an FDIC member

Legitimate banks will be members of the Federal Deposit Insurance Corporation (FDIC).

4. Unbelievable terms

Many fake banks will try to lure you in with unbelievable terms, such as “no interest loan” or an offer to give you money just for opening an account. Always keep the adage in mind: if it seems too good to be true, it probably is.

5. Inconsistent or poorly made websites

Most banks, especially online-only banks, put a lot of money and care into their websites. After all, these websites are an extension of the bank’s physical locations, or possibly the bank’s only way to make an impression. If the website is full of inconsistent design elements, misspellings, poor grammar, missing images, broken links, etc., there is a good chance that it isn’t a legitimate bank.

6. Links that don’t go anywhere

Many fake banking websites will have a page full of links to the programs they offer, but when you click on them, you’re not taken anywhere. They do this to appear as if they’re a full-featured bank without having to maintain a lot of bogus pages.

Last Updated: 1/2021

We support the latest version of Microsoft Edge and current versions of Firefox, Safari, and Chrome. The immediate prior versions of these browsers will only be supported if they are still supported by the browser company themselves. When a new version is announced as Release to Web (RTW), support will cease on the third-oldest major version.

Please note that utilizing older browsers may result in disabled functionality or limited access to services.

Supported Browsers

The supported browsers above are for use with the traditional online banking interface and devices (desktop/laptop), and do not apply to use with mobile devices (phones/tablets). If using a phone or tablet to access online banking outside of an app, functionality and appearance may vary from the traditional interface.

Note: It is not recommended to use Compatibility View with Internet Explorer, as the user experience is degraded.

Additional Browsers:

Browser usage is reviewed monthly. Additional browsers will be added if usage meets or exceeds 5% of total login activity.

Beta Versions:

Beta versions are not supported. When new versions of browsers are announced as ready to Release to the Web (RTW) by the provider, they will become a supported version.

Troubleshooting:

The following types of tools and/or access are not recommended and may impact experience:

Accessing accounts via an embedded browser such as:

Use of browser add-ins (emoticons, FunWeb services, etc.)

Online Banking allows you to access your BCB accounts straight from your computer, tablet or smartphone. Whether you're at home or on the go, online banking at BCB allows you to check your balance, deposit checks, pay bills, transfer money and manage your accounts.

In the payments section of online banking simply click on "Add a Payee."

Online Banking allows you to view the last 2 years of transactions from the time you registered to use Online Banking.

Online Banking and Bill Pay+ are free services provided to our customers.

+Pending Verification

No, only one mobile number can be enrolled.

Bal=All Acct Bal

Bal Mobile Short Name = Single Acct Bal

Hist=All Accts Recent Activity

Hist Mobile Short Name=Single Acct Activity

Help=Commands

Stop=Cancel

Users will need access to the internet using the default browser(s) included by their mobile device manufacturer or the latest mobile device. (Android tablets, screen resolution below 470x320dp and jailbroken or rooted devices are not supported) In addition, devices must support TLS 1.1 and TLS 1.2.

Mobile Banking Application

Apple: IOS 12.1 or higher

Android: 6.0 or higher

Text Banking

Users will need a MMS (multimedia messaging services) capable device.

V 21.03a

All text messages should be sent to 89549.

You must first enable your bank account(s) for online banking before using mobile.

To download the Apple App visit the App Store. To download the Android App visit the Play Store.

No. You will only receive messages when you specifically request them with one of the Text Banking commands.

In order to open a checking or business account, please visit one of our local branches and a BCB Employee will be happy to assist you.

You will be required to bring one primary and one secondary ID:

Secondary Documents - Major Credit Card or Debit Card from other financial institution

Yes, Individual customer accounts are insured by the FDIC up to $250,000 per owner. Greater FDIC insurance coverage may be available depending on account registration. Visit your local branch for more information or call 1-800-680-6872. FDIC insurance covers all types of deposits received at an insured bank, including deposits in a checking account, negotiable order of withdrawal (NOW) account, savings account, money market deposit account (MMDA), time deposit such as a certificate of deposit (CD), or an official item issued by a bank, such as a cashier's check or money order. FDIC insurance covers depositors' accounts at each insured bank, dollar-for-dollar, including principal and any accrued interest through the date of the insured bank's closing, up to the insurance limit. The FDIC does not insure money invested in stocks, bonds, mutual funds, life insurance policies, annuities or municipal securities, even if these investments are purchased at an insured bank.

The FDIC covers:

The FDIC does not cover:

Currently you cannot open an account online.

A savings passbook requires you to come to the bank to have your interest printed into your passbook as well as process transactions such as withdrawals and deposits. Statement savings accounts allow you the freedom to process transactions without the burden of a passbook that may get lost or stolen. You simply need to know your account number then fill out a deposit or withdrawal slip supplied at your local branch. Statement savings does allow you to have an ATM (debit) card so that you may withdrawal money at any ATM. You do not have that option with a passbook savings.

Yes, please visit your nearest branch to setup a wire transfer below is what you will need to wire money out:

Beneficiary: Name, Account Number, Complete Physical Address

Bank: Name, Routing Number, Complete Physical Address

For international transfers

International Bank: Name, SWIFT Code, Complete Physical Address

For incoming wire transfers

Receiving Bank: Name, ABA#, Complete Physical Address

Beneficiary: Name, Account Number, Complete Physical Address

Account Holder's: Name, Account Number, Complete Physical Address

Yes, please visit your nearest branch to setup a wire transfer below is what you will need to wire money out:

Beneficiary: Name, Account Number, Complete Physical Address

Bank: Name, Routing Number, Complete Physical Address

For international transfers

International Bank: Name, SWIFT Code, Complete Physical Address

For incoming wire transfers

Receiving Bank: Name, ABA#, Complete Physical Address

Beneficiary: Name, Account Number, Complete Physical Address

Account Holder's: Name, Account Number, Complete Physical Address

Interest rates vary on a daily basis; call 201-823-0700 for current rates.

Yes there is an option to have the receipt print without the check image.

Yes there is also an option to receive a text or email receipt. When at the ATM, in the preferences section, enter your email address or phone number. You can select to receive a text message or email.

No, deposits can only be made into your BCB Bank accounts.

There is no difference but the ATM will accept deposits after regular banking hours.

The ATM will accept multiple cash denominations to be deposited at one time.

No, you will not incur any fees for making deposits at the ATM.

Visit your local branch or call Customer Care 1-800-680-6872 for more information.

Contact BCB Bank at 1-800-680-6872 immediately and a representative will be able to assist you with this matter. If you have the BCB App, you can suspend or cancel your card. Click here to learn more about suspending or cancelling your card.

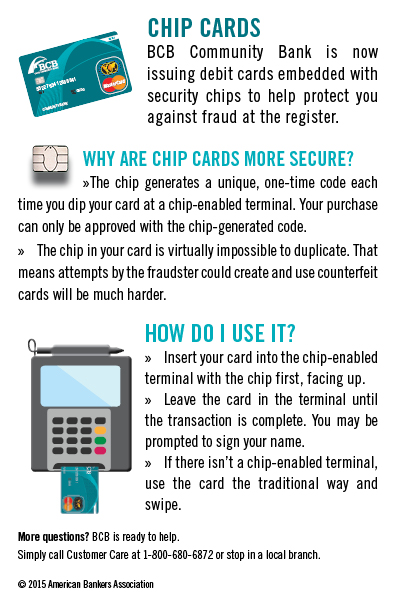

A chip card - also known as an EMV Card - is BCB's way of adding an extra layer of security when you pay in person. Chip Cards can be used anywhere your other cards are used, but the chip functionality only works at businesses that has an activated chip-enabled terminal.

eStatement is an electronic statement that replaces the current paper statements.

eDelivery is way to get eStatements without signing up for Online Banking.

No there is no cost in receiving your statements through eStatement.

You will receive an email when your eStatement is ready.

If you are registered via Online Banking it will be sent to the email you have linked to your Username.

If you are registered via eDelivery it will be sent to the email you signed up with.

All check images are listed on the last page of your statement.

Call Award Headquarters at 1-800-854-0790

The ScoreCard Rewards Program has a complete list at www.scorecardrewards.com.